Sign up for MarketBeat All Access to gain access to MarketBeat's full suite of research tools:

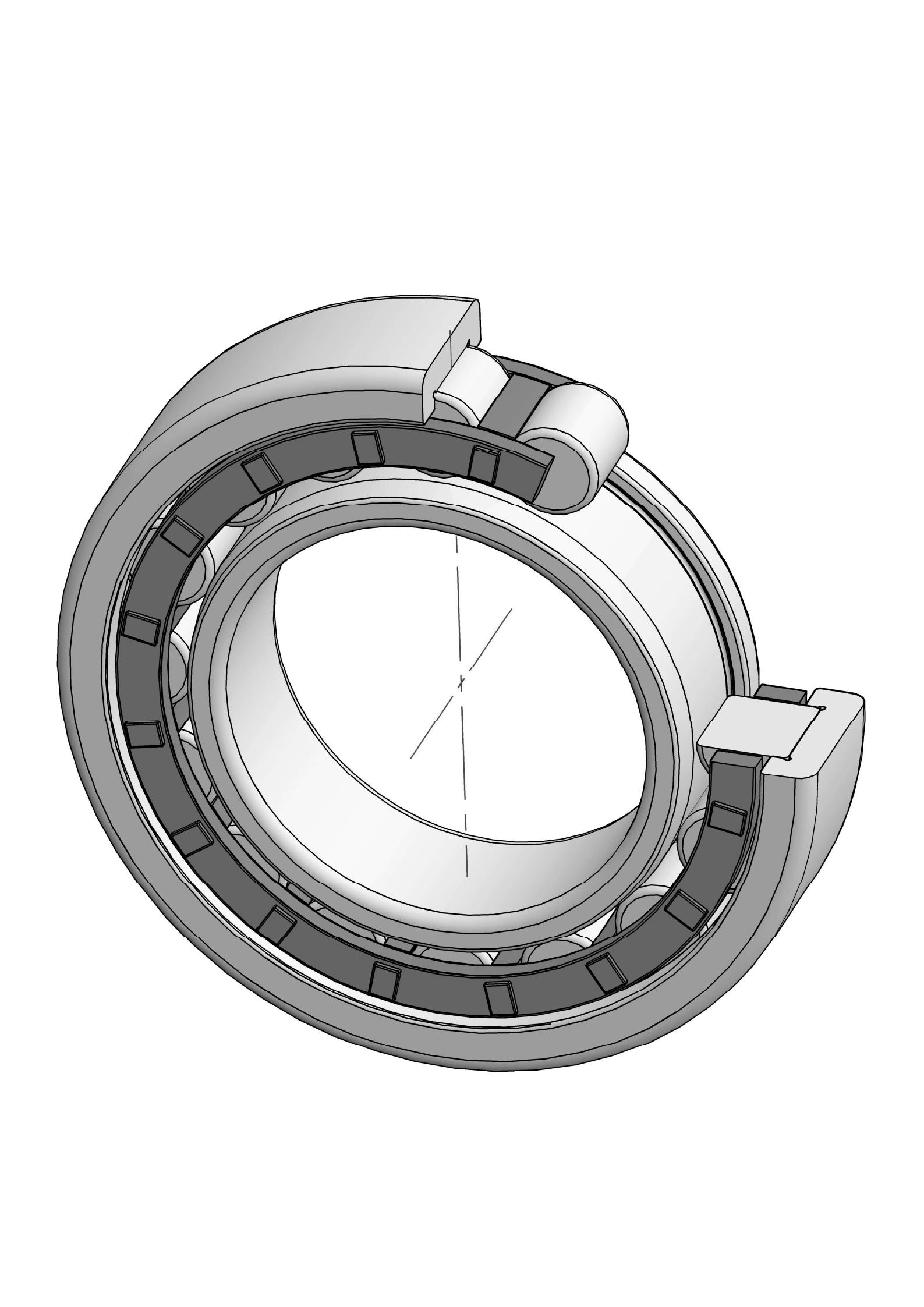

Dimensional Fund Advisors LP raised its stake in RBC Bearings Incorporated (NASDAQ:ROLL - Get Rating) by 1.6% in the third quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 208,287 shares of the company's stock after purchasing an additional 3,220 shares during the period. Dimensional Fund Advisors LP owned approximately 0.72% of RBC Bearings worth $43,284,000 as of its most recent SEC filing. Joint Bearing

A number of other hedge funds and other institutional investors also recently made changes to their positions in ROLL. State of New Jersey Common Pension Fund D boosted its position in RBC Bearings by 4.4% in the 3rd quarter. State of New Jersey Common Pension Fund D now owns 16,587 shares of the company's stock valued at $3,447,000 after buying an additional 696 shares during the last quarter. Nelson Van Denburg & Campbell Wealth Management Group LLC raised its position in RBC Bearings by 12.7% during the third quarter. Nelson Van Denburg & Campbell Wealth Management Group LLC now owns 5,857 shares of the company's stock worth $1,217,000 after acquiring an additional 661 shares in the last quarter. Royce & Associates LP raised its position in RBC Bearings by 22.2% during the third quarter. Royce & Associates LP now owns 182,825 shares of the company's stock worth $37,993,000 after acquiring an additional 33,157 shares in the last quarter. Geneva Capital Management LLC raised its position in shares of RBC Bearings by 5.0% in the third quarter. Geneva Capital Management LLC now owns 574,349 shares of the company's stock valued at $119,355,000 after purchasing an additional 27,189 shares during the period. Finally, MQS Management LLC bought a new position in shares of RBC Bearings in the third quarter valued at about $236,000. Wall Street Analysts Forecast Growth

Separately, StockNews.com initiated coverage on shares of RBC Bearings in a research report on Sunday. They issued a "hold" rating on the stock.RBC Bearings Trading Down 0.4 %

NASDAQ:ROLL opened at $233.45 on Wednesday. RBC Bearings Incorporated has a 52 week low of $152.90 and a 52 week high of $264.94. The company has a market capitalization of $6.75 billion, a price-to-earnings ratio of 113.33 and a beta of 1.34. The business's 50-day simple moving average is $227.62. About RBC Bearings (Get Rating)

RBC Bearings Incorporated manufactures and markets engineered precision bearings and components in the United States and internationally. It operates through two segments, Aerospace/Defense and Industrial. The company produces plain bearings with self-lubricating or metal-to-metal designs, including rod end bearings, spherical plain bearings, and journal bearings; roller bearings, such as tapered roller bearings, needle roller bearings, and needle bearing track rollers and cam followers, which are anti-friction products that are used in industrial applications and military aircraft platforms; and ball bearings include high precision aerospace, airframe control, thin section, and industrial ball bearings that utilize high precision ball elements to reduce friction in high-speed applications.Featured StoriesGet a free copy of the StockNews.com research report on RBC Bearings (ROLL)Will Q4 Results Send Zoom Video Stock Higher? Is Amazon a Blue Chip Stock? Occidental Petroleum Pulls Back To The Sweet SpotShould You Take a Cruise in Royal Caribbean Stock?Is Target Stock Aiming For A Breakout In 2023?

Want to see what other hedge funds are holding ROLL? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for RBC Bearings Incorporated (NASDAQ:ROLL - Get Rating).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider RBC Bearings, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and RBC Bearings wasn't on the list.

While RBC Bearings currently has a "hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Sign up for MarketBeat All Access to gain access to MarketBeat's full suite of research tools:

View the latest news, buy/sell ratings, SEC filings and insider transactions for your stocks. Compare your portfolio performance to leading indices and get personalized stock ideas based on your portfolio.

Get daily stock ideas from top-performing Wall Street analysts. Get short term trading ideas from the MarketBeat Idea Engine. View which stocks are hot on social media with MarketBeat's trending stocks report.

Identify stocks that meet your criteria using seven unique stock screeners. See what's happening in the market right now with MarketBeat's real-time news feed. Export data to Excel for your own analysis.

326 E 8th St #105, Sioux Falls, SD 57103 contact@marketbeat.com (844) 978-6257

© American Consumer News, LLC dba MarketBeat® 2010-2023. All rights reserved.

Aluminum Alloy Bearings © 2023 Market data provided is at least 10-minutes delayed and hosted by Barchart Solutions. Information is provided 'as-is' and solely for informational purposes, not for trading purposes or advice, and is delayed. To see all exchange delays and terms of use please see Barchart's disclaimer.